Apple has long owned a lucrative slice of the international smartphone market. Now, the company may be able to carve a bigger piece of the pie with the upsized iPhone models it has recently introduced in the market. It seems that the investors of the company are betting on this very fact as the share price of the company has seen an 18% boost since last month when the company published the results of its fiscal fourth quarter. Apart from that, the share price has increased about 50% in the whole year, which has made it the best-performing stock amongst the large tech companies.

The optimism of investors cannot be called far-fetched even if the market capitalization of the company reached dizzying heights this week when it reached $700 billion. Apple was just a niche computer maker, but the introduction of the iPhone transformed it into the most valuable company of the world. Nonetheless, the company has remained confined to the upper crust of the smartphone market because of its unrelenting focus on making premium design. For the first nine months of 2014, the company’s global sales were about 13% whereas 26% of the market belonged to its rival, Samsung Electronics.

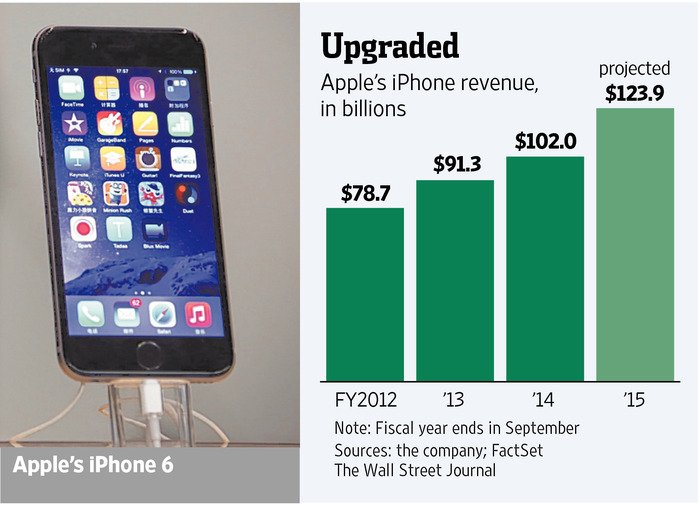

But, there might be a shift in dynamics now; the Cupertino, California firm finally made its venture into the larger-screen smartphone market with the iPhone 6 and the iPhone 6 Plus. This negated the advantage that was enjoyed by other smartphone makers, especially Samsung Electronics and other Android-based manufacturers. This was obvious in the quarter results that were announced at the end of September, which included the release of the iPhone 6. In this period, the sales of the devices increased by 16% where Samsung’s smartphone shipments were reduced by 8%. It is expected by analysts that in the December quarter, the iPhone shipments will exceed 60 million.

This increase would come at the expense of competitors as 19% of other users said that they were thinking of making the switch to the iPhone with their next purchase. Therefore, it is a tantalizing possibility that the iPhone maker could regain additional smartphone market share. Every individual who purchases an iPhone becomes a part of the iOS platform and the mix of content also seems to be shifting towards profitable apps and services instead of lower margin sales of movies and music. It has been projected that next year the sales of the company’s App Store will be more than iTunes media sales.

The only problem that the company may face is in regard to its refusal to play in the low-end smartphone market. Nevertheless, it isn’t necessary for the company to be the share leader if it wishes to be a profitable business. This is especially true if it continues to introduce new and unique services into its ecosystem such as Apple Pay. Some nervousness is inspired by the market capitalization and the strong run-up of the stock, but there is no reason to hang up on this firm as it remains the top innovator.

![Watch Video Now on xiaohongshu.com [以色列Elevatione perfectio X美容仪 perfectio X 全新仪器黑科技了解下]](https://www.techburgeon.com/wp-content/uploads/2019/07/perfectiox-singapore-150x150.jpg)