New technology continues to improve our lives and make them easier. Everything from keeping up with friends, shopping and watching your favorite shows and movies has been digitized for our convenience. However, one of the most unique benefits of modern technology is the ability of transferring money to people all around the globe without much hassle. This is an excellent upgrade because it eliminates the risk of your cash being lost if you send it through traditional methods. Furthermore, they also save a lot of time and money is almost immediately transferred in some cases, which is extremely handy in case of emergencies.

Some of the different ways that modern technology has had an impact on money transferring services are mentioned here:

- Alternative Payment Services

Today, there are a large number of websites that enable buyers and sellers to transfer money via email for avoiding revealing their credit card information or bank account details online. Approximately one-third of online payments are made via these websites when we indulge in online shopping. The most popular of these websites is PayPal, which hosts more than 90 million business and personal accounts and it is touted as the faster and safer way of making online payments. They have an extensive fraud-prevention and online security center to protect information of their users.

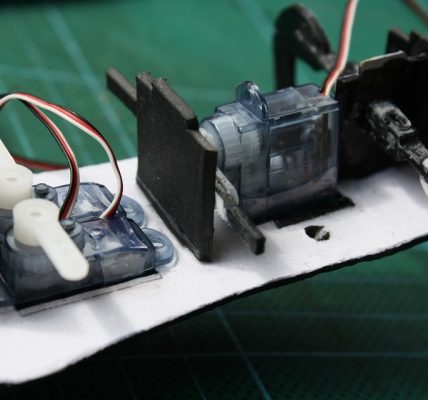

- Mobile Magnetic Stripe Readers

There are mobile applications that you can use for swiping your credit cards on small scanners that are attached to your smartphones. These apps have taken increased security measures for protecting their customers from chargeback transactions and fraud.

- Donation Texts

Text messages are also being used for transferring money, especially in the case of making donations. However, in this case, you have to ensure that you are entering the correct number because scammers can take advantage of this method for stealing cash.

- Mobile Applications

There are numerous apps you can use for transferring money online these days. PayPal and Google Wallet also have their apps. One more renowned app is Venmo, which is also owned by PayPal. It makes use of credit and debit cards for making payments and charges three percent for sending money. No charges are levied when you are receiving money, but there is a weekly limit to the amount that can be sent. You need some identifying information like your Facebook account details or zip code.

With the launch of Apple Pay, you now have another option of making payments as it is gradually gaining popularity. The key is to use this technology in a smart and careful manner for ensuring your details aren’t compromised. There are a lot of benefits you can enjoy by using modern technology for transferring money. Online shopping has also become immensely convenient because methods such as Payoneer card don’t require you to even have a bank account. This means that anyone can take advantage of these services for sending or receiving money in the online word. As technology continues to evolve, more and more services are likely to be introduced. In addition, websites like sendmoneyaustralia.com/nz are also doing great when it comes to sending money internationally.

![Watch Video Now on xiaohongshu.com [以色列Elevatione perfectio X美容仪 perfectio X 全新仪器黑科技了解下]](https://www.techburgeon.com/wp-content/uploads/2019/07/perfectiox-singapore-150x150.jpg)